By Hans Hansen, CEO of Brand3D

Just over 10 years ago, 3D printing was hyped to be a game changing technology that would revolutionize both consumer product manufacturing and – as a consequence thereof – retail. Major players including Google (Project Ara: https://en.wikipedia.org/wiki/Project_Ara) announced break-throughs in 3D printing, whereby traditional processes could be replaced by on-demand, hyper personalized consumer products to be printed at large scale 3D printing facilities. At the other end of the spectrum, companies such as 3D Hubs promised to reinvent manufacturing and logistics by offering “last mile” production whereby every city would host “hubs” of 3D printers. Each hub would then receive digital blueprints from designers that in turn would be 3D printed into consumer ready products, and then picked up by the customer in a “FedEx terminal” type outlet in the consumers vicinity.

Problems in scaling and maintaining sufficient quality and reliability in the 3D printing processes came in the way of these ambitious plans and while Google abandoned the personalized mobile phone business altogether, 3D Hubs is today a specialized 3D printing service primarily focussed on prototyping and art production. At the same time, the massive scale in ecommerce has driven down logistics costs further limiting profitability of these services.

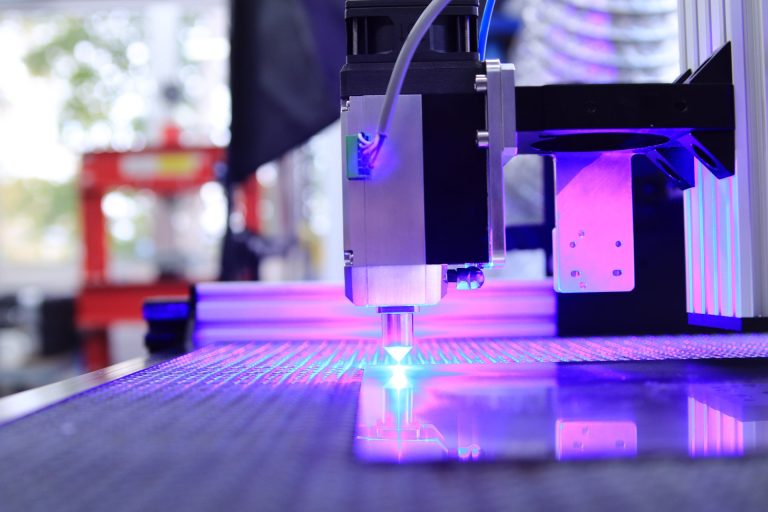

However, as 3D printing processes constantly improves, there is an increasing probability that these ideas may reemerge soon. 3D printing is – unlike other mass production methods such as injection molding or laser cutting – both a matter of scaling in quantities and in geographical distribution and scale. In order to expand 3D printing beyond a prototyping step before “real” production, it is imperative to scale production along both these parameters.

The answer must still be to find the right balance between centralized printing at facilities that can guarantee quality, speed and reliability, as well as local specialized printing facilities that can take the “long-tail” of the market with less QA requirements but higher urgency requirements.

Furthermore, advances in robotics and AI may enable production processes that are beyond what we can possibly imagine today. Large scale printers can already build micro-homes, such as this one by the startup Icon, but the achilles heal of these production processes are the requirement to maintain tubes to a resin reservoir or melting of rods of printing material. What if the process could be made wireless by autonomous printing robots that would travel to and from a “supply chain” of printing material and inject the material at just the right location at the right time. This would allow a nearly unlimited scale and flexibility in the process and these robots would be mobile in nature and could easily be moved from location to location and thereby finally deliver on the promise of “near consumer” production using 3D printing.

More importantly, the 3D visualization capabilities available to ecommerce retailers that have since become available may also drive the need for 3D printing. Using 3D visualization technology, such as Augmented Reality or Visual Product Configurators, online shoppers can quickly tailor a product in the virtual space and view it in their surroundings using their mobile phone. A natural next step would be to take the resulting myriad of options for virtual personalization and realize these with on-demand printing.

3D printing technology allows consumers to personalize many form-factors: from the finest lattice surfaces at a micro scale, to large industrial structures, the technology allows us to produce forms used to create bone structures, fine biological implants, affordable housing, emergency shelters, with many other possibilities. These growing options for on-demand, personalized and on-location production will likely drive a host of new retail opportunities that align well with the current trends in ecommerce. While Amazon, Walmart and a handful of the largest retailers may still hold the majority market share, a growing “long tail” of smaller, specialized retailers are emerging. These retailers could work with specialized 3D printing providers to create scalable niches that use regional 3D printing facilities to deliver “near instant” product processes on demand in the future.

Finally, as retail evolves from using “just in time” demand fulfillment to “on demand” fulfillment, where a growing number of purchases are made online or via apps, 3D printing further gains in relevance. Most consumer goods are produced in batches of millions of units in order to drive down pricing. This requires inflexible production cycles that are out of sync with how consumers prefer to purchase by impulse. Having 3D printing facilities at your retailer and thereby allowing a nearly instant production and delivery experience is bound to drive up the demand for 3D printing. As with same day delivery, most consumers did not realize that this was a priority until the service was introduced by Amazon. In a similar way, the first major brands to introduce on demand, near-instant delivery for – say – shoes or apparel may capture a significant portion of the market – especially if the product offers full personalization such as the name of the consumer printed in custom colors – already a feature available on shoes from Nike and others. This is likely to be the real game changer for 3D printing – to provide the user with an instant, virtual 3D product personalization and delivery experience of the future.

About the author

Hans Hansen is the CEO of Brand3D. Over the past 20 years, he has developed products and new ventures in the areas of Artificial Intelligence, 3D technologies, M2M automation, Internet of Things, Mobile Marketing, Fitness and Health Monitoring and Social Web Services. He founded five companies, one in the US, 3 in Denmark and one in the Baltics.

Related Articles

5 Strategies for Scaling BOPIS Operations During Holiday Peak Season

Companies across various sectors are leveraging automation to enhance in-store experiences and improve customer satisfaction, including within BOPIS systems. It is shown to bolster productivity and decision-making, too.

How to Evaluate Retail Automation Solutions for Your Business

To achieve the benefits of retail automation, you must find the right partner. Consider the following tips to make an informed decision.

How To Navigate Running a Business With Family As Co-Workers

Keeping business transactions above board is especially important for business owners who have integrated their family into the company. Transparent communication and documentation will help to protect yourself and your business from accusations of nepotism.

Hexnode CEO on how the “Holiday Illusion” is Masking the Risks of Retail’s Seasonal Workforce

The danger of seasonal hires is magnified not just by who is accessing the network, but when they are doing it. Sophisticated threat actors possess a deep understanding of the retail operational calendar.

for the latest news and job opportunities in retail tech

for the latest news and job opportunities in retail tech